47+ tax deduction for mortgage interest calculator

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Ad Accurately determine interest on federal and state tax underpayments and overpayments.

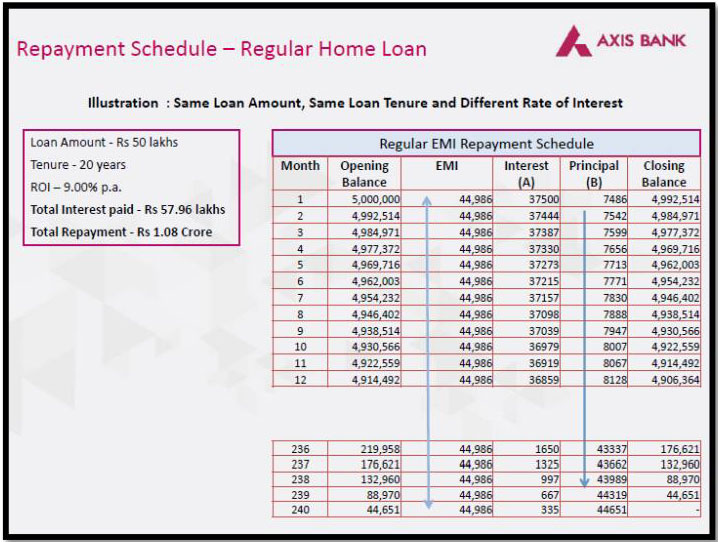

Education Loan Emi Calculator Education Loan Calculator Online Axis Bank

Ad File your federal tax return for FREE and State Only 995.

. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Find out with our online calculator. Taxes Can Be Complex.

The home mortgage interest deduction HMID is one of the most cherished American tax breaks. Web The traditional monthly mortgage payment calculation includes. Use this calculator to determine how much your.

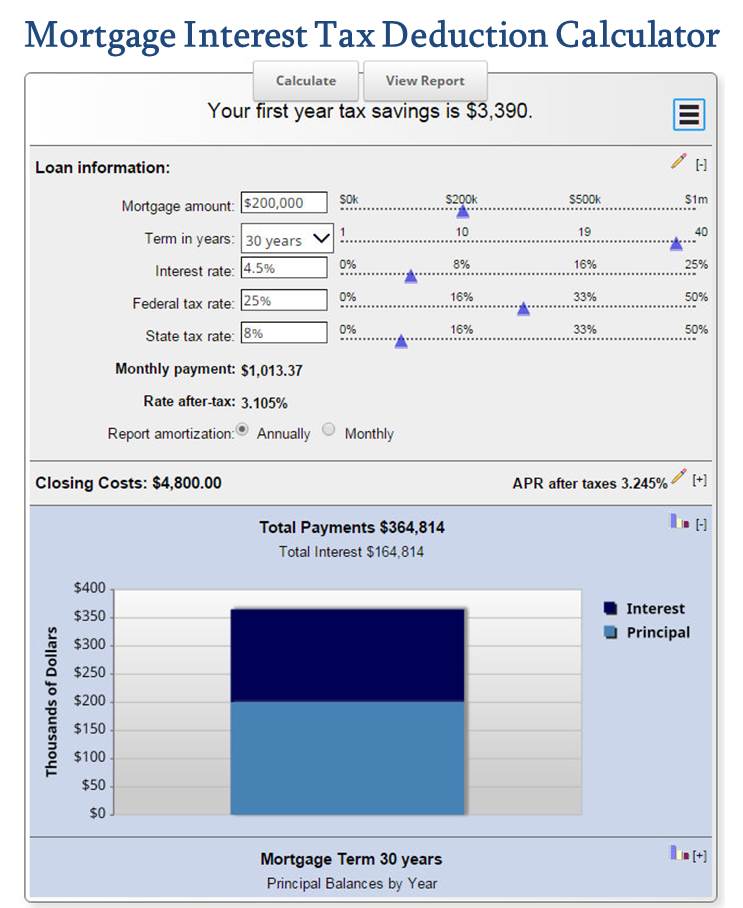

Web 371 rows Mortgage Interest Tax Deduction Calculator to calculate how much tax you. Built-in interest calculations for all federal and state jurisdictions with income taxes. Web First Revisit the Mortgage interest topic and delete the form 1098 and click done to clear all the entries and start over.

However higher limitations 1 million 500000 if married. I have the Turbotax home and business desktop 2022 and the mortgage interests for 2022 in the itemized deductions form A is forcing. Web The home mortgage interest deduction HMID is one of the most cherished American tax breaks.

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Homeowners who bought houses before December 16. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket.

In truth the myth is often. Click the Online tab at the top of the. Web With the mortgage tax deduction calculator you can get an idea of exactly how much youll be able to deduct from your taxes each year through your mortgage.

In truth the myth is often better than reality. Web Mortgage payment tax calculator deduction calculator Interest and points paid for a home mortgage are tax deductible. The cost of the loan.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web Calculating the Home Mortgage Interest Deduction HMID For example if you spend 20000 on mortgage interest your tax bill is not reduced by 20000. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The amount of money you borrowed.

Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the first. Web Mortgage interest tax deduction calculator. Please note that if your.

You can claim a tax deduction for the interest on the first. So the total Interest that is 1000000 5 50000 will be deducted from the total. Web Mortgage Tax Calculator.

The interest paid on a. File your Free Federal return and State tax return for only 995 at online taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Web How much can the mortgage tax credit give you tax savings. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Answer a few questions to get started. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Mortgage Tax Credit Deductions.

Web Mortgage tax deduction calculator - Use the mortgage tax savings calculator to determine how much your payments reduce your income taxes and if this deduction.

5 Reasons To Apply For Loan Against Securities Axis Bank

Tax Benefit Calculator Calculate Education Loan Tax Benefits Axis Bank

Quick Loans Apply For 24x7 Instant Loans Online Axis Bank

Mortgage Payment Tax Calculator Deduction Calculator

Here S A Smart Way To Reduce The Interest Outgo Of Your Home Loan Axis Bank

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Fixed Deposit Term Deposit Scheme Tax Saving Open Fd Account Online Indusind Bank

How To Calculate Mortgage Payments In Excel

Universal Credit Calculator How To Work Out How Much You Ll Get When You Switch Over Benefits The Sun

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Suppose A Loan Compounds Annually At The End Of The Year Loan Payments Are Also Made At The End Of The Year Which Is Applied First To The Principal The Compounding Interest

Mortgage Interest Deduction Tax Calculator Nerdwallet

Loan Emi Calculator

Fd Calculator Calculate Fixed Deposit Returns Interest Axis Bank

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Mortgage Calculator

-(1).jpg)

Top 5 Car Loan Tips For Youngsters Axis Bank